Stay nimble over the coming week and let price action dictate the path forward

Hey everyone — Senior Market Strategist Matthew Timpane here, stepping in for Todd while he’s out on vacation. It’s been a while — almost a year to the day since you last heard from me. Last week, we saw messy price action heading into the June quarterly OPEX, which isn’t unusual per se, as there is often a lot of repositioning. This time of year usually creates some temporary choppy price action as it sets the stage for the seasonally bullish month of July. However, this year we’re staring down a barrage of concerns, with geopolitical risks now front and center — particularly the ongoing Israel–Iran conflict and U.S. involvement.

On the flip side, when we look under the hood, animal spirits seem to be coming back to life. So, we find ourselves at an inflection point — one where neither side has a clear upper hand just yet. Let’s dive in ...

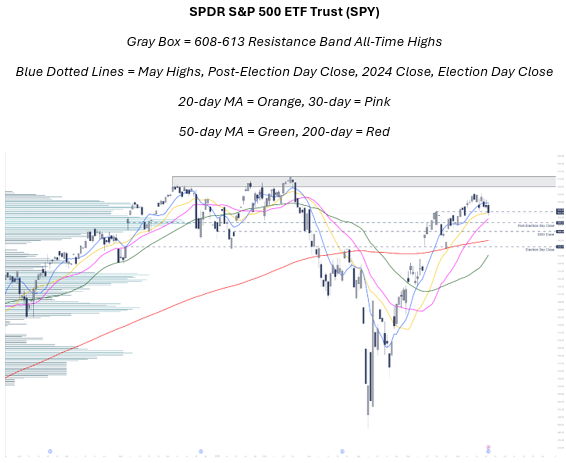

The S&P 500 (SPX – 5,967.85) finished lower for the second straight week after failing to break above the 6,050 level — an area it rejected three times in four trading days. The SPDR S&P 500 ETF Trust (SPY -- 594.28) slipped below both the May closing highs and the 20-day moving average, however, the index has not. Nevertheless, both the index and the ETF remain above the 30-day moving average — a level that has often caught fake-out moves. That area also aligns with several key markers: the post-Election Day Close, the one-year Volume Point of Control, and the first major put strike at the 590 level on the front three-month open interest configuration. If this is just a shakeout before another leg higher, I’d expect buyers to step in around those levels.

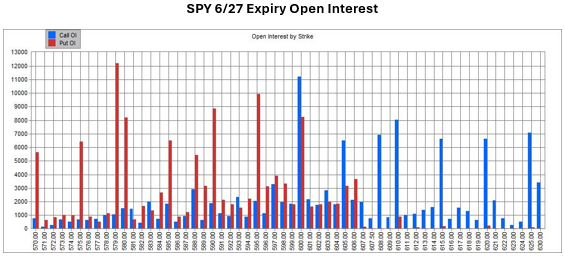

In the immediate days ahead, the call-heavy 600 strike stands out on the SPY. Evidence suggests that most of these calls were bought (to open). As such, the implication is unwinding of long positions associated with those calls represents a risk to bulls if the SPY remains below this strike into Friday’s expiration.

-Monday Morning Outlook, June 16, 2025

Looking a little deeper, the current SPY open interest for this week shows a large concentration at the 595-strike put — nearly spot on with Friday’s close. If that level breaks, it could trigger a delta hedge unwind, pushing the market toward the 579–580 put strikes. That zone is notable, too, as it lines up with the 200-day moving average, the Election Day close, and would likely be the next spot where bulls attempt to step in if 595 or 590 fail to hold. Overhead, we’re still capped by the 600-strike peak call, which also serves as a balance point for open interest and is right near the flattening 10-day moving average. That’s your level to watch for any upside breakout. If cleared, a test of previous all-time highs becomes more likely, with established resistance in the 608–613 zone.

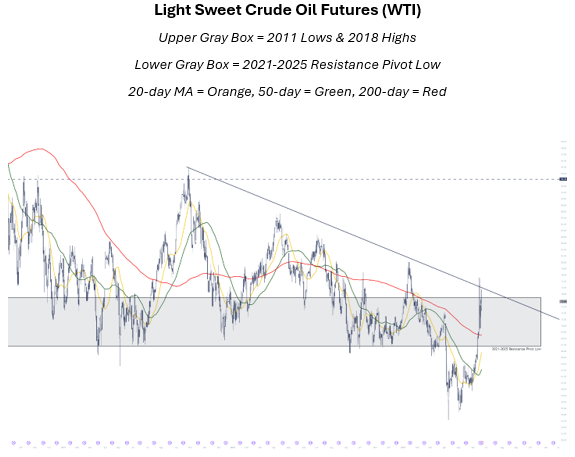

As mentioned at the top, the escalating conflict in Iran remains the most immediate risk to the market. A potential supply disruption from one of the world’s largest oil producers will put upward pressure on crude prices, raising costs for companies and potentially triggering broader market consequences — much like we saw when oil spiked at the onset of the Russia–Ukraine war. While the U.S. has sanctions already in place on Iranian oil and gas, Iran still holds the fourth-largest proven reserves and ranks as the seventh-largest producer globally. More critically, any disruption to the Strait of Hormuz — a vital chokepoint for 20% of daily global oil flows — could have immediate and far-reaching consequences for energy markets and risk sentiment.

So far, Crude Oil (WTI -- $73.84) has broken through the 1-year Volume Point of Control and long-standing $65–67 resistance band — a major pivot zone going back to 2021 — but it’s now pressing against a broader downtrend line near $77.50. A clean break there could send prices up quickly toward $83 area. Beyond that, resistance comes in around $93, followed by $110 — a level that has historically acted as a pivot point for major blow-off tops in oil. These types of commodity shocks often coincide with equity corrections — or worse — especially when accompanied by other macro headwinds.

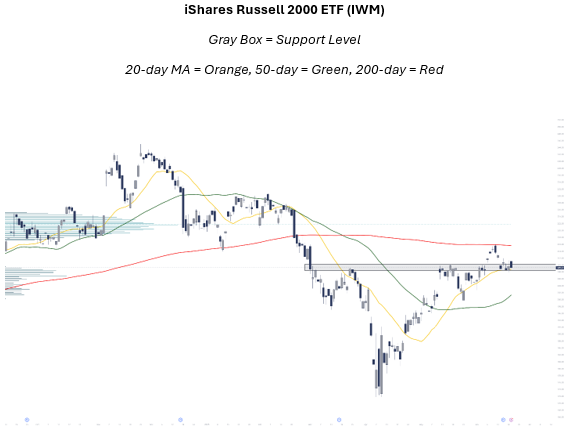

Now, here’s the good news: there are signs that risk appetite is reawakening. Small-cap stocks — as seen through the Russell 2000 ETF (IWM – $209.21) — managed to squeeze out a gain last week despite broader weakness and held above prior resistance. But even more telling are two data points that suggest speculation is heating up. First is the recent Goldman Sachs note on sub-dollar stocks. Volumes in this space have tripled since 2021 and just hit a record on June 12th, accounting for 47.4% of market volume on the day. Notably, 20% of this activity happens before the market opens, and over half takes place before 11 a.m. ET. That kind of trading behavior screams “animal spirits.”

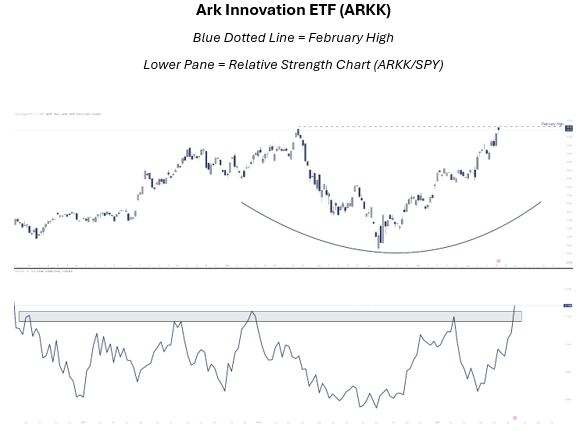

Secondly, take a look at ARK Innovation ETF (ARKK -- $67.73) . On a price basis, if ARKK can take out its February highs, it could be a signal that extreme bullish behavior is taking hold. Furthermore, the relative strength ratio of ARKK is already breaking out of a base. And, in my opinion, ARKK is an excellent gauge on the degenerate economy. Combine that with speculative interest in small-caps and sub-dollar names, and you’ve got a recipe for a feverish move in equities. While these rallies often end poorly, they’re too powerful to miss.

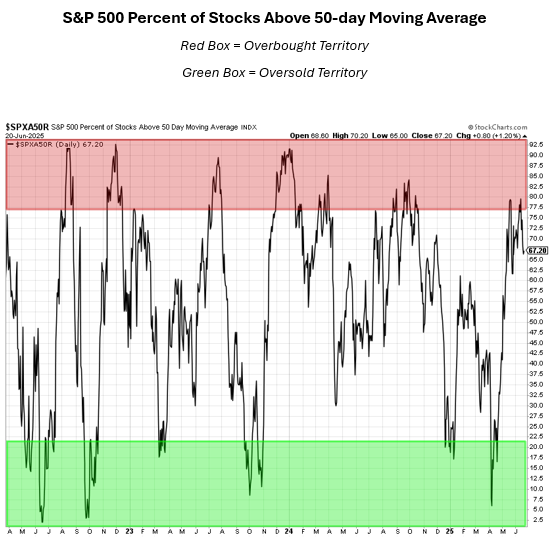

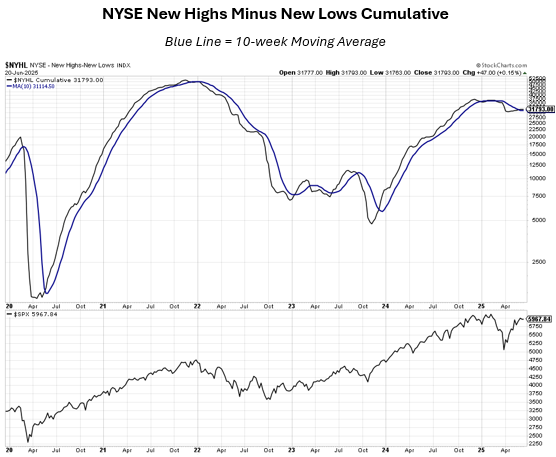

Short-term sentiment gauges show markets are a bit stretched. Both the S&P 500 and Nasdaq have seen a decline in the percentage of stocks above their 50-day moving averages after reaching overbought territory. However, the cumulative New Highs minus New Lows has crossed back above its 10-week moving average — a historically bullish sign that typically precedes multi-month advances.

The Cboe Volatility Index (VIX -- 20.61) also spiked back above the 20-handle and held it — suggesting caution in the near-term. So, it’s difficult to add a lot of long-term exposure until we see how this unfolds. Tactical short-term trades and even layering in some hedges make sense as we head into quarter-end. That said, a quick reset lower could flush out weak hands and reset the board for another push higher — provided bulls can hold one of the key support levels outlined above.

Stay nimble over the coming week and let price action dictate the path forward. It might not be what people want to hear — but it’s what the market structure is telling us.

Matthew Timpane is Schaeffer's Senior Market Strategist

Continue Reading: